If the headlines of recent weeks are to be believed, the electric car hype seems to be over and the efforts of traditional manufacturers have been in vain. If you look at the figures, however, the exact opposite is the case. Electric car sales have risen by more than 30 percent worldwide, exceeding the growth rates – if any – of combustion engines many times over. In some markets, such as China, the number of combustion car sales has even fallen. Pioneers such as Norway hardly have any significant sales of diesel and gasoline cars anymore; there, electric cars dominate the market and the streetscape. In other words, combustion engine sellers would lick their fingers for figures like those reported for electric cars.

But how did the negative reporting and rumors about the end of the electric car boom come about?

Reasons for the negative reporting

Well, firstly, there are the growth figures, which are still at 30 percent, but are much lower than in previous years, when manufacturers were spoiled with annual growth rates of up to 130 percent. The reasons for the slump at a high level are, on the one hand, the expiring subsidies and, on the other hand, the lack of cheaper electric cars on offer, which could open up a new customer base and thus drive sales figures up enormously. There is no lack of customer interest either. A survey in 12 countries showed that 70 percent of respondents were very likely to buy an electric car as their next vehicle.

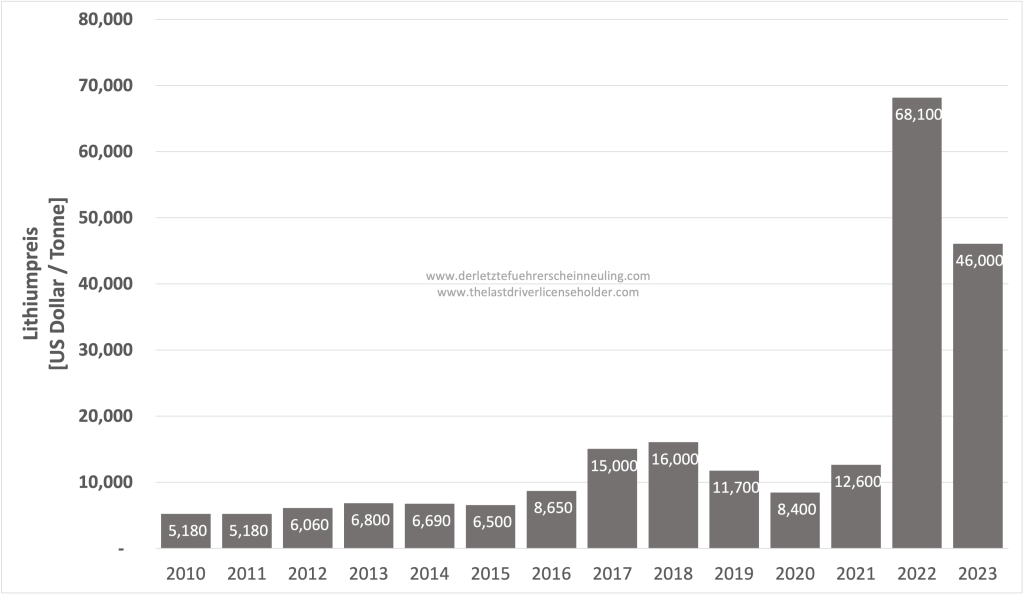

Secondly, traditional manufacturers are realizing how challenging the development and production of a competitive electric car is – keyword: production hell – and how low their profit margin is. Or rather: how much the late converts are losing with electric cars. Because by jumping on the electric car boom late, which they refused to believe in for a long time, they missed out on securing resources at favorable prices. The example of lithium, which is needed for batteries, quickly makes this clear.

While a tonne of lithium cost around 5,180 dollars in 2010, the price rose thirteen-fold to 68,100 dollars in 2022 and was still nine times higher in 2023 than in 2011 at 46,000 dollars. The situation appears to be easing in 2024 with current prices of over 10,000 dollars per tonne, but the first manufacturers are already switching to sodium ion batteries.

While Tesla, as the first mover, was able to secure lithium for just under 5,000 dollars, its followers had to pay many times more years later. A veritable scramble for resources ensued, driving prices up. This almost unfair cost advantage in raw materials allowed Tesla to instigate price wars and choke off other manufacturers. Competitors either risked turning their already slim profit margins into losses or, if they did not follow suit, ruining their sales figures.

The fact is that most manufacturers have to cross-subsidize their electric cars massively with the profits from combustion engine sales. If combustion engine sales fall and electric car sales rise, there is not much money left to pay for the electric car subsidies. Years ago, the head of Fiat said that every electric Fiat 500 had to be cross-subsidized with up to 9,000 euros. GM also lost a similar amount with every Chevrolet Bolt sold. Tesla, on the other hand, enjoys profit margins that are only surpassed by Ferrari.

And it’s not just raw material prices that are the competitive advantage, but also the longer learning curve that early adopters like Tesla have had with electric cars. Incredibly short innovation cycles, constant improvements, deep vertical integration in manufacturing, as well as a vehicle designed from the outset as a fully digital machine allow Tesla to keep costs low while innovating at high speed.

Tesla also achieved a competitive advantage that is difficult to imitate by not having to build its own Supercharger network. The advantage is so great that all car manufacturers in the USA are now adopting the NACS charging standard used by Tesla in the hope of being able to use Tesla’s charging station network in the future. For a long time, Tesla’s own networks were never considered necessary, until it was realized that they were an extremely important decision criterion for customers. Not only that: as it turns out, Tesla can offer the installation of Superchargers at a quarter or fifth of the price of its competitors. For the same price, Tesla can install 4 or 5 Superchargers and thus scale its network much faster than others.

The consequence of all this is that the competitors have hardly seen a chance and the adoption of the standard is more or less a capitulation and an admission of their own failure. As a traditional manufacturer, however, you don’t want to admit this and invent all sorts of other reasons for your own failure:

- Customers don’t want electric cars;

- They are not profitable to produce;

- They are too expensive to repair;

- The resale value deters customers;

- The range is too short;

- There are no cheaper electric cars;

- Who needs all the digital frippery when everyone wants a rich engine sound?

- The horse was better and has a great future.

Numbers in Detail

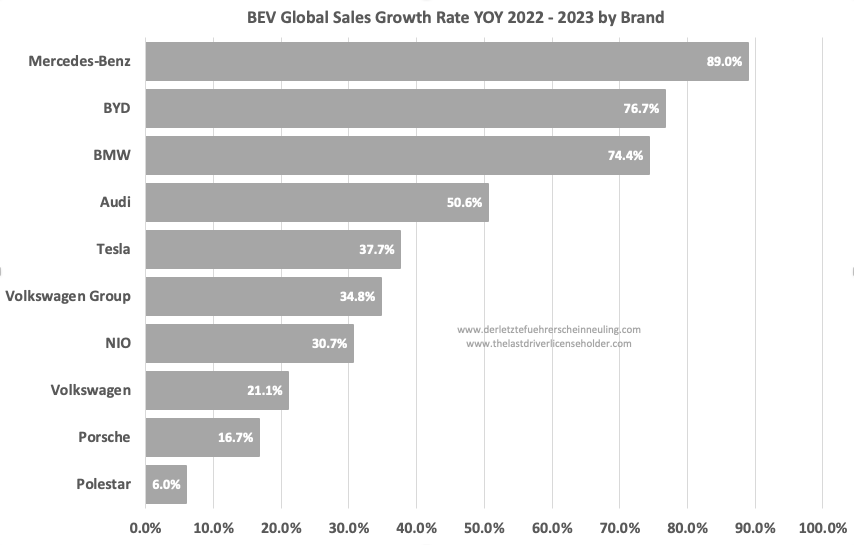

Let’s take a closer look at the sales figures and announcements of the last few weeks. I already posted and discussed this graph of electric car sales growth a few weeks ago.

As impressive as these figures are for German manufacturers and electric car fans, they also show that in absolute terms Tesla has even widened the gap on the German manufacturers. Tesla delivered 408,196 more cars in 2022 than BMW, Mercedes-Benz and the VW Group combined, and a further 30,602 more in 2023. Tesla delivered 438,798 more cars than the German manufacturers combined.

| Delivery | 2022 | 2023 | Delta |

| BMW | 215,755 | 376,183 | 160,428 |

| Mercedes-Benz | 117,800 | 222,600 | 104,800 |

| VW Group | 572,100 | 771,000 | 198,900 |

| German Manufacturers combined | 905,655 | 1,369,783 | 464,128 |

| Tesla | 1,313,851 | 1,808,581 | 494,730 |

| Difference Tesla – German Manufacturers | 408,196 | 438,798 | 30,602 |

So there is nothing in the past about the popular statement that “once the German manufacturers get going, Tesla will have to dress warmly”.

But here are some selected manufacturers in detail.

Volkswagen

Volkswagen sold 394,000 electric cars worldwide in 2023, an increase of 21.1 percent. However, this figure is disappointing, as global sales rose by 30 percent. The Volkswagen brand therefore performed worse than the global market and lost market share, while the Volkswagen Group as a whole achieved an increase of 34.8 percent.

More than 3.2 million cars were sold in China in 2023, three million of which were combustion vehicles. The sales figures for purely battery-electric cars rose by 23 percent. The increase in market share for combustion engines from 19 to 20 percent in China is not due to Volkswagen’s strength, but primarily to the general decline in combustion engine sales. VW is thus increasing its market share in the shrinking market for combustion vehicles, which is not a long-term strategy.

The difficulties in selling electric cars from VW are home-made. The problems with the software are not going away, and word has gotten around. Whereas digital wasn’t even an afterthought before, it is now a key selling point, not to mention the usability of a modern electric car. No matter how much you blame the lack of customer interest, if the market is still growing faster than your own sales, you are simply offering a product that the market thinks sucks. The fault and the blame lie with yourself.

While VW is (still) making a profit with combustion engines, the situation is different with electric cars. While the overall operating profit margin for 2023 was 6.7 percent, the company had to postpone its prospects of a profit margin for electric cars that will be equal to that of combustion engines until 2025. The massive price war, not only on the Chinese market, is leading to losses for many suppliers.

Mercedes-Benz

Mercedes-Benz, on the other hand, was able to increase its growth in pure electric cars by 89 percent, but the company has nevertheless revised its decision to phase out combustion engines. This probably has less to do with the sales figures for electric cars than with the profit margins.

Mercedes-Benz changed its strategy a few years ago to focus on higher-value and luxury segments. Only there did Mercedes-Benz hope to achieve corresponding profit margins on electric cars. The Mercedes-Benz electric car for the masses will therefore not exist.

Whether this strategy will work is unclear. On the one hand, autonomous cars are another disruptive technology that needs to be invested in and where a mass product can help to provide the necessary small change; on the other hand, the recent announcement that combustion engines will now be produced for longer than planned seems to point to internal forecasts that would ruin the hoped-for profit margin with a higher proportion of electric cars in the portfolio. As I said, the company was late in securing raw materials for electric cars, and this is now taking its toll on profit margins.

BMW

Like Mercedes-Benz, BMW also achieved impressive growth in electric cars in 2023. The Munich-based company increased its sales by 74.4 % compared to the previous year and sold 376,183 electric cars. This apparently surprised even the board member, which had long railed against electric cars and in favor of technological openness.

The question is, however, whether BMW has actually underperformed in 2023 despite the management’s long-standing resistance to building electric cars? Where would the sales figures be if BMW, instead of getting bogged down with hydrogen cars and investments in combustion technology, had not immediately focused more on the electric car range and perhaps even had an electric BMW 3 Series in the corresponding price range in its portfolio? We will probably never find out.

Ford

Ford recorded a loss of 4.5 billion dollars (4.15 billion euros) with its electric cars in 2023. For every electric car sold, Ford made a whopping 36,000 dollars in losses. Although demand for the F-150 Lighting electric pickup increased by 55 percent, the absolute increase from 15,000 to 24,000 units is a small number when you consider that Ford sells 750,000 pickups a year.

GM

General Motors actually wanted to sell several hundred thousand electric cars this year and overtake Tesla in just a few years. But first things are different than you think. This year, after some teething troubles, GM managed to sell 75,000 electric cars, 93 percent more than in the previous year. However, it was not cars on the new Ultium electric car platform, on which GM is pinning all its hopes, that proved to be the best-sellers, but the tried-and-tested Chevrolet Bolt, production of which was also discontinued at the end of the year. Sales figures in the fourth quarter of 2023 were also just below those of the third quarter, an astonishing fact, as the fourth quarter traditionally tends to be higher than the third quarter.

In total, Gm managed just 14,000 electric cars on the Ultium platform, which will now have to carry electric car sales in 2024 alone. And some brands, such as the Chevrolet Blazer, will not be allowed to be sold for the time being due to technical problems. It will probably be a fateful year for GM, in which it will become clear whether the company has the slightest chance of turning things around.

KREATIVE INTELLIGENZ

Über ChatGPT hat man viel gelesen in der letzten Zeit: die künstliche Intelligenz, die ganze Bücher schreiben kann und der bereits jetzt unterstellt wird, Legionen von Autoren, Textern und Übersetzern arbeitslos zu machen. Und ChatGPT ist nicht allein, die KI-Familie wächst beständig. So malt DALL-E Bilder, Face Generator simuliert Gesichter und MusicLM komponiert Musik. Was erleben wir da? Das Ende der Zivilisation oder den Beginn von etwas völlig Neuem? Zukunftsforscher Dr. Mario Herger ordnet die neuesten Entwicklungen aus dem Silicon Valley ein und zeigt auf, welche teils bahnbrechenden Veränderungen unmittelbar vor der Tür stehen.

Conclusion

There can be no talk of an end to the electric car boom. The negative reports are being spread by traditional manufacturers, who are painfully having to admit that electric cars are here to stay and will replace combustion engines, and are realizing that they cannot keep up with agile newcomers in many areas. Traditional manufacturers have not mastered electric car technology and the digital component as well as Tesla or Chinese companies in a number of areas, nor can they bring the cost structure to a level where they can offer competitively priced and profitable electric cars on the market.

The negative reporting on electric cars is nothing more than the lamentation of traditional manufacturers who, after years of missing the trend and then hastily cobbling together a “we-also-have-an-electric-car”, first wondered why nobody wanted their unconvincing electric cars and now want to blame everyone else for their own failures.

This article was also published in German.

1 Comment