The struggle for dominance in the automotive sector is running along all fronts. If electric cars were “only” about batteries or electric motors, competitors might be able to catch up with Tesla. If you add software, it becomes exponentially more difficult for companies from a non-software environment. Now, however, the Asian Nikkei Business Publications has taken a close look at the electronics installed in Tesla vehicles since April 2019 and had them examined by engineers from a major Japanese car manufacturer.

The result is shocking. One engineer said that this type of electronics will not be available for his own company until 2025 at the earliest. The problem is not money or knowledge. The stumbling block is much more the supply chain that has been built up over decades and is delicately balanced.

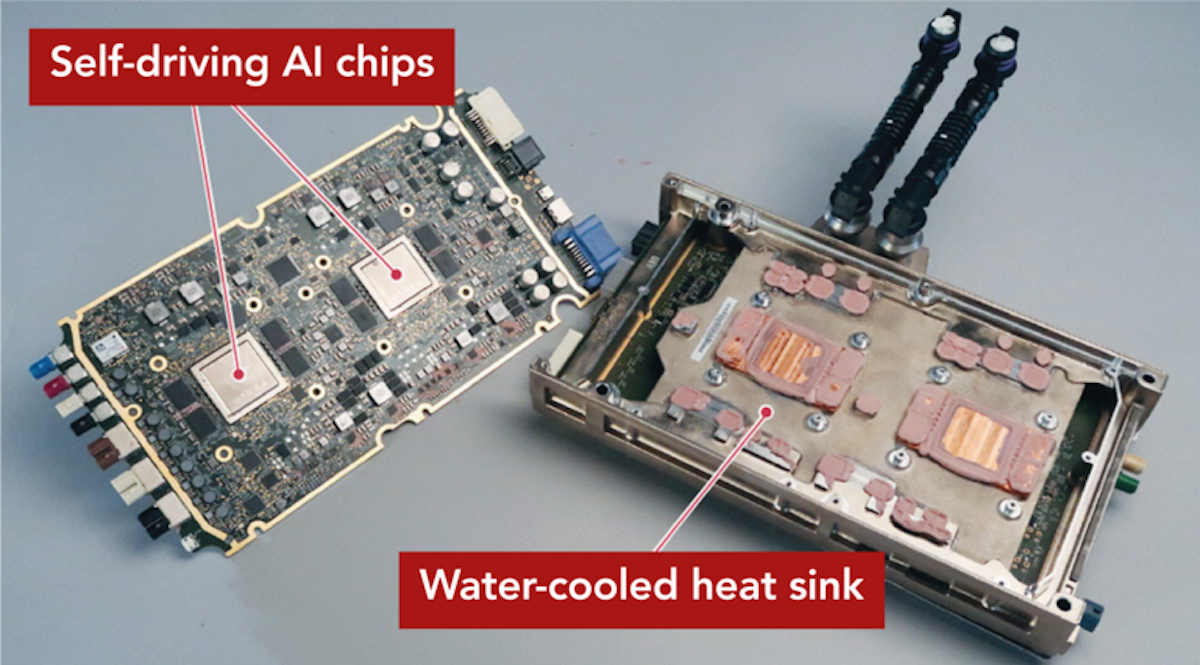

Tesla’s integrated central control unit – vulgo: self-driving computer with 2 self-developed AI chips – is the key to processing the massive amounts of data required for autonomous cars.

Traditional manufacturers have relied on their suppliers for various car parts, and many of them are equipped with ECUs (Electronic Control Units) which are controlled by the individual suppliers. Tesla’s hardware, on the other hand, reduces this number from dozens of ECUs to just a few, making changes to the hardware and especially software updates much easier.

Switching to such an electronic architecture would lead to major disruptions among car manufacturers and suppliers. The control over the ECUs would switch to the manufacturers, and with it the responsibility for faulty control systems etc. This threatens many jobs at the suppliers who are currently responsible for these control units.

Electronics, on the other hand, is only one area in which they’d need to catch up. Thanks to these electronics, the cars already supply data today and can in turn be accessed by Tesla from customer vehicles. Data that benefits the AI/machine learning system, which serves the further development of self-driving technology. One can already guess the gap in technology development that a traditional manufacturer has until such electronics can be installed in their own cars in 2025 at the earliest. Only then will the data collection in their own cars begin, 6 years after Tesla started to do so.

The only measure – without simply buying Tesla, but that is no longer an option with the current market value of Tesla – is to radically change your own supply chain. But nobody dares to do that, and probably still way to many people at traditional car companies believe in it. A double dilemma…

Update: Here is a presentation by VW which, on slide 9, lists how many ECUs a VW has on average (70) and how many suppliers are involved (200+)

This article was also published in German.

3 Comments